This guide explores how quantum computing is reshaping the financial landscape, offering unprecedented computational power to solve problems that were once considered impossible. Whether you’re a finance professional looking to future-proof your career or a technology enthusiast curious about real-world quantum applications, understanding this intersection of quantum physics and finance has never been more valuable.

What is Quantum Computing and Why Finance Needs It

Quantum computing represents a fundamental shift in computational power. Unlike classical computers that process information in binary bits (0s and 1s), quantum computers use quantum bits or “qubits” that can exist in multiple states simultaneously thanks to the principles of quantum mechanics. This property, called superposition, combined with quantum entanglement, allows quantum computers to process vast amounts of information and explore multiple solutions simultaneously.

The financial sector faces increasingly complex challenges that push classical computing to its limits:

- Portfolio optimization across thousands of assets with multiple constraints

- Real-time risk assessment requiring billions of scenario calculations

- Fraud detection patterns hidden in massive datasets

- Option pricing models with numerous variables and market conditions

- Secure transactions resistant to future computational threats

These challenges involve combinatorial optimization problems that scale exponentially, making them perfect candidates for quantum computing solutions. Financial institutions that adopt quantum computing early will gain significant competitive advantages, including the ability to see market opportunities invisible to competitors using traditional computing methods.

Ready to Master Quantum Finance?

Our comprehensive course bridges quantum computing and finance, making complex concepts accessible to beginners while providing practical applications for professionals.

Key Quantum Principles Made Simple (No Math Required)

Understanding quantum computing doesn’t require an advanced physics degree. The key principles can be grasped through simple concepts:

Superposition

While classical bits are either 0 or 1, qubits can exist in both states simultaneously. This is like being able to explore all possible investment scenarios at once rather than checking each one sequentially.

Entanglement

Quantum particles can become “entangled,” meaning the state of one instantly affects another, regardless of distance. In financial terms, this allows for modeling complex correlations between different market factors simultaneously.

Quantum Interference

Quantum states can interfere with each other, canceling out incorrect solutions and amplifying correct ones. This helps quantum algorithms converge on optimal solutions for complex financial problems much faster.

Quantum Tunneling

Quantum systems can pass through energy barriers that would be insurmountable in classical systems. In optimization problems, this helps avoid getting stuck in local optima, finding truly optimal investment strategies.

These principles enable quantum computers to tackle complex financial problems with unprecedented efficiency. For example, a portfolio optimization problem that might take years on a classical computer could potentially be solved in minutes on a sufficiently powerful quantum computer.

Real-World Financial Applications of Quantum Technology

Financial institutions are already exploring practical applications of quantum computing. Here are the key areas where quantum technology is making significant inroads:

Quantum-Powered Trading Strategies

Trading optimization represents one of the most promising applications of quantum computing in finance. The complexity of today’s financial markets has increased exponentially, with derivatives valuation models like the XVA umbrella (including credit, debit, funding, capital, and margin adjustments) becoming increasingly sophisticated.

“Because combinatorial optimization problems in trading and portfolio management scale exponentially, quantum computers have the potential to find faster, more cost-effective and better-tailored solutions than classical machines.”

Quantum algorithms excel at:

- Portfolio Diversification: Optimizing asset allocation across thousands of potential investments while balancing multiple constraints and objectives

- Dynamic Rebalancing: Rapidly adjusting portfolios in response to market movements and changing investor goals

- Derivatives Pricing: Calculating complex derivatives values with greater accuracy and speed

- Arbitrage Detection: Identifying pricing inefficiencies across markets that are invisible to classical computers

Real-World Example: JPMorgan Chase has been utilizing quantum computing to optimize its investment portfolio management, replacing traditional Monte Carlo simulations with quantum algorithms to significantly speed up portfolio optimization processes.

Revolutionizing Financial Cryptography

Quantum computing presents both challenges and opportunities for financial security:

Quantum Security Opportunities

- Quantum Key Distribution (QKD) offering theoretically unbreakable encryption

- Enhanced fraud detection through quantum pattern recognition

- Secure multi-party computation for sensitive financial transactions

- Quantum-resistant cryptographic algorithms protecting long-term assets

Quantum Security Challenges

- “Harvest now, decrypt later” attacks threatening currently encrypted financial data

- Need to transition to post-quantum cryptography before quantum computers break current encryption

- Digital signature vulnerabilities potentially compromising financial transactions

- Legacy systems requiring significant updates to maintain security

Financial institutions must begin preparing for the post-quantum cryptography era now, as the transition will take years while the threat to current encryption methods grows. The US National Institute of Standards and Technology (NIST) released post-quantum encryption standards in 2024, providing a roadmap for financial organizations to secure their systems.

Stay Ahead of Quantum Security Challenges

Our course covers both the opportunities and challenges of quantum cryptography in finance, preparing you to protect assets while leveraging quantum advantages.

Advanced Risk Management with Quantum Computing

Risk management is essential in financial services, particularly in insurance, banking, and investment. Traditional risk models often fail to capture all variables influencing outcomes, and classical computing struggles with the computational demands of comprehensive risk analysis.

Quantum computing transforms risk management through:

| Risk Management Application | Classical Computing Limitation | Quantum Computing Advantage |

| Monte Carlo Simulations | Limited by scaling of estimation error | Quadratic speedup for scenario analysis |

| Credit Scoring | Overlooks complex patterns in customer behavior | More accurate assessments through quantum machine learning |

| Regulatory Stress Tests | Limited number of scenarios due to computational constraints | Broader range of more complex stress scenarios |

| Fraud Detection | High false positive rates (80%) | Enhanced pattern recognition reducing false positives |

The business value for financial institutions comes from four main scenarios: enhancing investment gains, reducing capital requirements, opening new investment opportunities, and improving risk and compliance management.

Case Study: Huaxia Bank worked with SpinQ to develop a quantum neural network algorithm to optimize ATM placement and management. By analyzing data from 2,243 ATMs across China, the quantum AI model predicted which ATMs should be reduced based on usage trends, failure rates, and replenishment timing with 99% accuracy, outperforming classical algorithms in both speed and precision.

The Future of Quantum Finance: What to Expect

Quantum computing will begin significantly transforming the financial services landscape over the next five years, with profound changes expected within the next decade. Financial institutions that adopt quantum early can seize major competitive advantages, potentially leapfrogging competitors to become market leaders.

Key developments to watch for include:

- Quantum-Classical Hybrid Systems: The most immediate applications will use quantum computers working alongside classical systems, with quantum processors handling specific computational tasks

- Quantum Machine Learning: Enhanced financial models that can detect subtle patterns in market data invisible to classical algorithms

- Quantum-Secured Financial Networks: Implementation of quantum key distribution for ultra-secure financial transactions

- Custom Financial Instruments: New types of financial products designed specifically to leverage quantum computational advantages

- Regulatory Frameworks: New standards and regulations addressing quantum computing’s impact on financial markets

Career Opportunities in Quantum Finance

As quantum computing transforms finance, new career opportunities are emerging at the intersection of these fields:

Quantum Financial Analyst

Professionals who understand both quantum algorithms and financial markets, capable of designing and implementing quantum-enhanced financial models.

Quantum Risk Manager

Specialists in applying quantum computing to risk assessment, stress testing, and compliance, creating more robust risk frameworks.

Quantum Security Specialist

Experts in post-quantum cryptography and quantum-secure communications for financial institutions, protecting assets from future threats.

These emerging roles command premium salaries and offer significant career advancement opportunities as financial institutions compete for talent in this specialized field. Professionals who combine financial expertise with quantum computing knowledge will be uniquely positioned to lead innovation.

Future-Proof Your Finance Career

Our comprehensive quantum finance course provides the knowledge and skills you need to capitalize on these emerging opportunities—no prior quantum experience required.

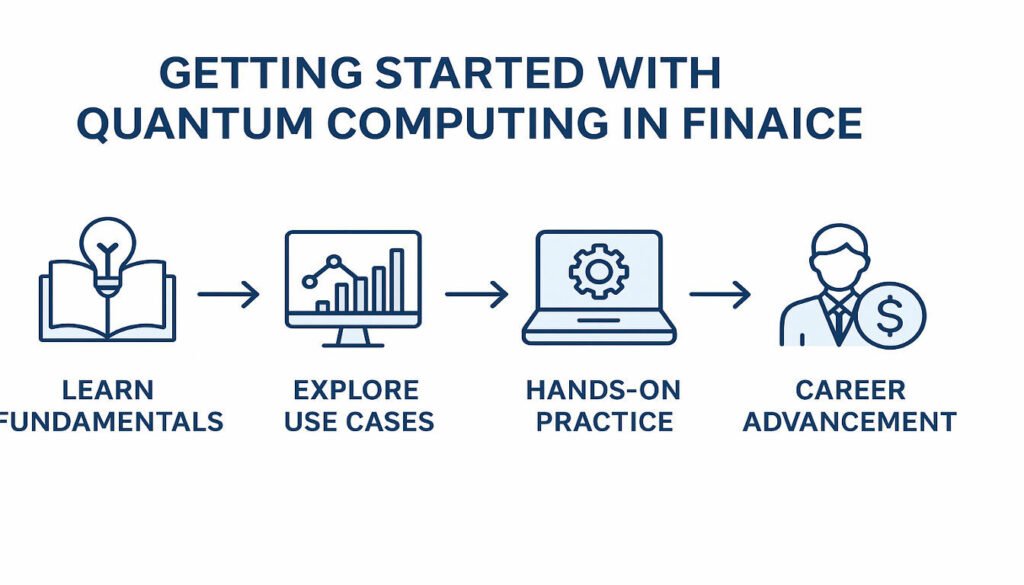

Getting Started with Quantum Computing in Finance

For financial professionals and organizations looking to prepare for the quantum future, here are practical steps to begin your quantum journey:

- Understand the Fundamentals: Start by learning the basic principles of quantum computing and how they apply to financial problems. Our course provides an accessible introduction without requiring advanced mathematics or physics.

- Identify Potential Use Cases: Evaluate specific areas within your organization or career where quantum computing could provide significant advantages, such as portfolio optimization, risk assessment, or fraud detection.

- Experiment with Quantum Algorithms: Begin testing quantum algorithms through cloud-based quantum computing platforms that allow experimentation without significant hardware investment.

- Build Cross-Disciplinary Teams: Combine expertise in finance, data science, and quantum computing to create innovation teams that can explore practical applications.

- Develop a Quantum Readiness Strategy: Create a roadmap for quantum adoption, including security considerations, skill development, and potential partnerships with quantum technology providers.

Do I need a background in physics to understand quantum computing for finance?

No, our course is specifically designed to make quantum computing accessible to finance professionals without requiring advanced physics or mathematics. We focus on practical applications and intuitive explanations of quantum principles.

How soon will quantum computing impact my finance career?

The impact is already beginning with early applications in portfolio optimization and risk management. Within 3-5 years, quantum computing skills will likely become highly valuable in financial services, with mainstream adoption expected within a decade.

What types of financial problems are best suited for quantum computing?

Problems involving combinatorial optimization, Monte Carlo simulations, and machine learning are particularly well-suited for quantum advantage. This includes portfolio optimization, risk assessment, fraud detection, and derivatives pricing.

Conclusion: Embracing the Quantum Revolution in Finance

Quantum computing represents a paradigm shift for the financial industry, offering unprecedented computational power to solve problems that were previously intractable. From optimizing investment portfolios and enhancing risk management to revolutionizing security and fraud detection, quantum technology will transform every aspect of financial services.

Financial institutions that embrace quantum computing early will gain significant competitive advantages, while professionals who develop quantum finance expertise will find themselves at the forefront of this revolutionary field. The time to prepare for this quantum future is now.

Our comprehensive course bridges the gap between quantum computing and finance, making complex concepts accessible while providing practical knowledge you can apply immediately. No prior quantum experience is required—just bring your curiosity and financial knowledge.

Transform Your Understanding of Finance with Quantum Computing

Join thousands of forward-thinking finance professionals who are already preparing for the quantum revolution. Learn at your own pace, from anywhere, with our comprehensive quantum finance course.